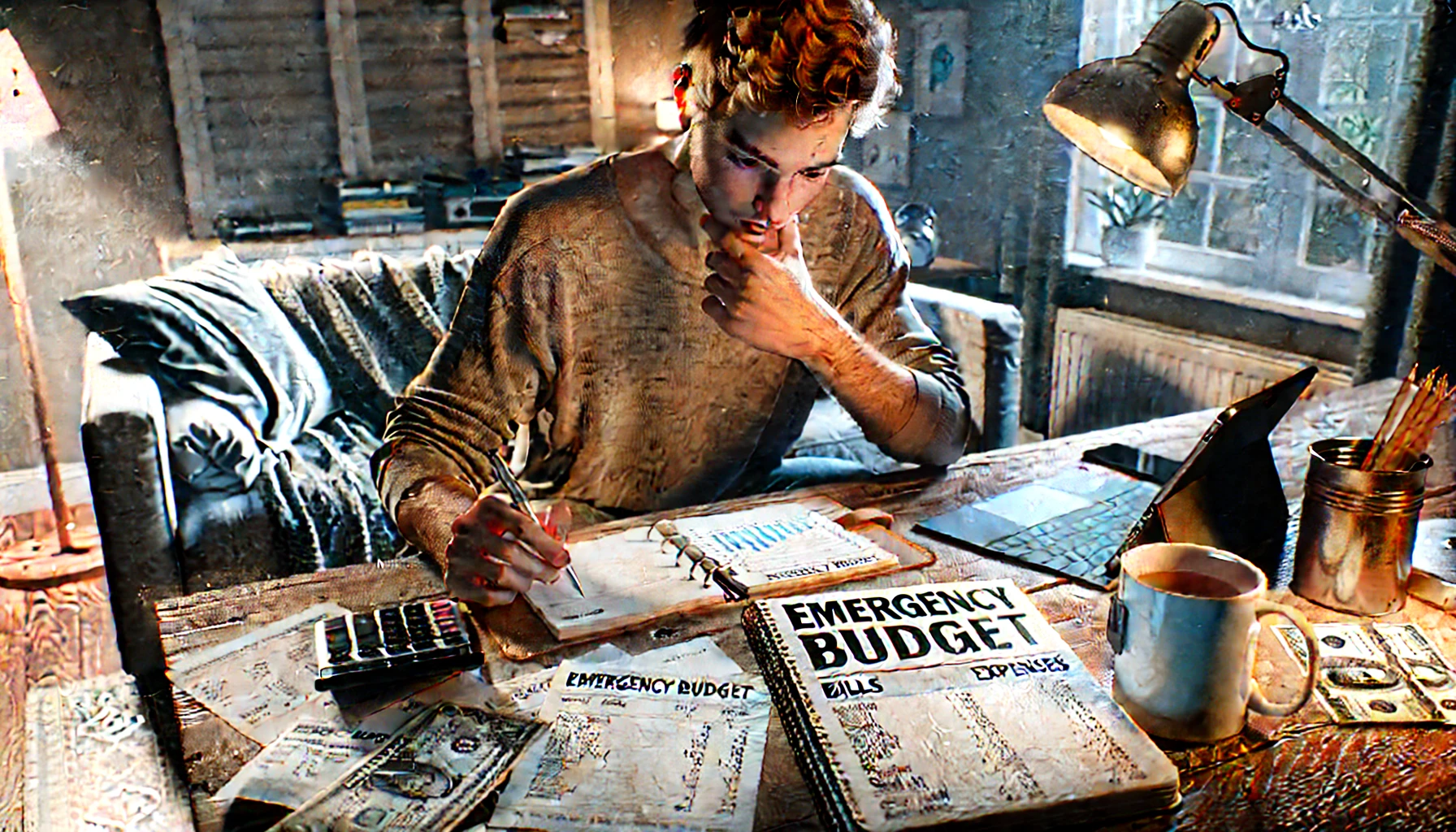

How to Create a Simple Emergency Budget When Things Get Tight

Sometimes life throws you a curveball—unexpected job loss, reduced income, surprise bills. And when that happens, the usual budget might not cut it. That’s when you need an emergency budget. An emergency budget is a temporary financial plan that helps you stay afloat, avoid debt, and prioritize what really matters—until things stabilize. In this article, … Read more